Debt and Depression – What You Need to Know

by Andrea M. Darcy

photo by Mikhail Nilov for Pexels

In debt and worried about your mental health? Debt and depression are definitely connected.

Debt and mental health

With a few credit cards here, a mortgage there, we live in a world where debt is increasingly available to us as a way to have the lifestyle we want. Live now, pay later.

But we can find ourselves living with non-stop anxiety as we worry how we will ever find our way out of the increasing sinkhole money issues can become.

And for many of us that anxiety can take over our lives, then lead right to depression. Or, worse, end up suicidal.

The debt charity Step Change estimates that at least 50 per cent and more likely as high as 90 per cent of people in debt feel anxious or depressed.

How are debt and depression related?

So what exactly leads to debt and depression being so connected? Reasons can include:

- feeling like a failure that we are in debt

- sensing loved ones don’t approve of our financial situation

- feeling we’ve let others down

- pushing others away out of shame then feeling alone

- sleepless nights due to worry (sleep issues and depression are connected)

- turning more and more to addictions that further lower our mood like alcohol and drug abuse

- panicking and making other bad life decisions that see us feel even worse.

Does debt CAUSE depression, or does depression cause debt?

By: Keoni Cabral

It’s a ‘chicken or egg’ situation as it’s often true that emotional health issues are part of what leads us to be prone to getting into debt in the first place.

Self-esteem issues or stress are often what cause us to originally overspend. They can lead to a misguided quick-fix attempt to try to feel better about ourselves or distract ourselves from our troubles through shopping.

Depression can lead to money issues as it leaves us foggy headed and tired all the time, unable to focus. It can affect our work performance and career, at worse leading to being made redundant. And with the low confidence depression brings it can feel too hard to find other work.

The truth is that the more you are prone to emotional challenges, the more you are vulnerable to money issues.

According to Britian’s Money and Mental Health policy institute, founded by money expert Martin Lewis, people who have mental health problems are three and a half times more likely to be in problem debt. In fact one in five find themselves with this additional problem.

Debt and suicide

The institute also shares that people in problem debt are three times as likely to have considered taking their own life in the past year.

In fact the recent cost of living crisis and impending recession has seen a rise in those thinking about suicide. The institute shares that their research polling over two thousand adult found a shocking one in eight people behind on a bill have attempted suicide.

So yes, debt and depression can be very serious bedfellows indeed, and something you should take seriously.

(Feel you are in danger of hurting yourself or others? Call emergency services or go to your nearest ER. If you are struggling with suicidal thinking you can also call one of several free helplines where understanding volunteers are happy to talk to you).

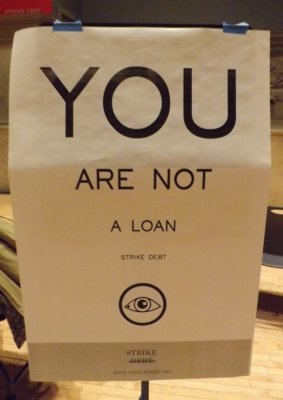

You are not your debt

Drowning in debt and depression can lure us into the obsessive belief that we are an utter failure. That only vast amounts of money can change our lives or see us happy again.

Drowning in debt and depression can lure us into the obsessive belief that we are an utter failure. That only vast amounts of money can change our lives or see us happy again.

These are not true statements, but what are called ‘cognitive distortions‘, assumptions we mistake as real.

Anyone can end up in debt. It doesn’t mean you are flawed. It can mean things like that while other people perhaps had parents teaching them about money, you didn’t, so were doing the best you can. Or you were given bad advice, or had a bad year work wise.

And you don’t have to be rich to be happy. Most people find that instead they need to feel safe, or like they are on the right path. If you make certain steps to deal with your debt, alongside with certain steps to deal with your underlying depression and shame, you might find that you can get out of that hole of depression far before you actually resolve your debt.

Coping with financial worries

The NHS suggests the following when dealing with debt and depression:

- stay active, making an effort to see friends and keep up hobbies like exercise

- face your fears (so get help with debts instead of putting your head in the sand)

- don’t just turn to drinking alcohol

- keep up your daily routine.

We’d suggest another very important tip — seek support. Shame can mean we think nobody will understand or find it hard to reach out (our article on ‘how to ask for help‘ can be a good read here). But remember most of our friends generally want us to be happy, and do want to help. They don’t want to see us consider harming ourselves just because of something like money.

Can debt counselling help?

Debt counselling, talking to someone who deals with debt strategy, is very helpful and can be a free, government funded service here in the UK. Look into charities like the National Debtline and Step Change.

Actually then don’t overlook psychological counselling for debt. Again, depression leaves us very foggy headed. And anxiety can see us making illogical, panicked decisions.

Working with a talk therapist means you can experience the relief of a safe, non judgmental space to finally unload your money worries. You can also learn how to:

- manage your thoughts so you don’t end up too depressed to function

- control your anxiety so you don’t make illogic decisions

- make better choices that help over hinder you

- set useful goals then actually achieve them

- figure out what you really want from your life and career so that you feel more inspired to take action than ever before

- learn mindfulness, a tool proven to lower stress and anxiety

- recognise the inner resources you already have

- feel better about who you are and what you offer

- learn better relating skills so debt doesn’t leave you lonely.

Low cost or free support for debt and depression

But doesn’t a therapist cost too much? How can that work if you are drowing in debt? Note that nowadays there are many options for free or low cost counselling (our sister site of therapy listings even has many low cost therapists available). Otherwise, consider a support group. Or even an online forum where you can find support of others working through debt and depression and don’t even have to use your real name (such as the one at Money Saving Expert).

Need to talk to someone about debt and depression? We offer therapy for depression in three central London locations or over the internet. On a budget? Our sister site lists affordable UK-wide therapists you can book as soon as tomorrow.