7 Ways to Feel Better Despite Debt Problems

photo by Towfiqu Barbhuiya for Unsplash

by Andrea M. Darcy

In the red and overwhelmed? Is it even possible to feel better with debt problems?

Debt problems and depression

The buy now, pay later lifestyle can be hard to resist. Advertising is carefully designed to lure you into believing that using credit for things you can’t afford is a fast track to happiness.

Instead, debt can become overwhelming, and lead straight to heavy depression.

In fact those who are susceptible to debt problems are usually also prone to depression. Low self-esteem or emotional numbness is usually what made you overspend in the first place. (Learn more about how interconnected your money and your moods are in our article about debt and depression).

I will never be happy unless I am rich

It can be all too easy to convince yourself that you can never be happy again until you have money, but this simply isn’t true. Just like you were sometimes unhappy before you were had money problems, the truth is that you can sometimes be happy even now you are in debt.

The secret is to start separating your moods from your money.

And the good news is that by dealing with your depression because of debt? You might suddenly find that you have more energy and clarity to sort out your money situation.

7 Ways to Shift Your Depression Around Debt Problems

Here are 7 ways to start untangling your depression from your debt, and make moves to get your emotional health back on track despite your money troubles.

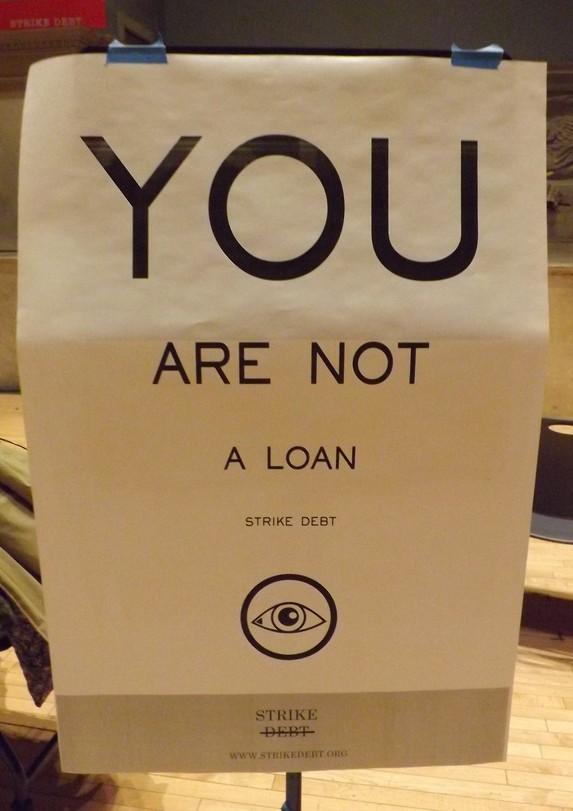

1. Recognise that you and your debt are not one and the same.

When you are struggling with debt problems it’s hard not to lose sight of yourself altogether. Every waking moment becomes about money and you can feel like a loser.

When you are struggling with debt problems it’s hard not to lose sight of yourself altogether. Every waking moment becomes about money and you can feel like a loser.

But you nobody’s value is actually connected to how much money they have or don’t. You are a person with many talents and lots to offer despite your money situation.

Make a list of all the things you offer the world and others. Perhaps you are funny, helpful, a good dancer, great at taking care of kids. Post it where you can see it daily to remember your real value. Add to it every time someone thanks you for something, or you notice something else good about yourself.

2. Stop the secretiveness.

Secretiveness is to depression like manure is to weeds. It makes for overgrowth. Debt problems and feeling low are not horrible diseases to keep mum about! This stigma is outdated and is behind many experiencing loneliness, isolation, and deeper levels of depression.

If you feel too ashamed to tell your friends just yet about your debt and debt-related depression, and need to practice talking about your issue? Call a free government funded debt counselling charity like Step change. Or find a debt support group near you. And don’t overlook a talk therapist, which can be done on a budget. Before you say a therapist costs too much read our article on how to find free or low cost counselling.

3. Change your perspective.

Our busy lives can quickly have us convinced the way we see things is the only way the world is, and that our thoughts are facts instead of assumptions. Try on some new perspectives around your life and your debts to help you find new ways forward and feel better.

Imagine you were talking to your 5 year-old self. Would they care if you were in debt, or ask you to play? Or what would Richard Branson say? He would probably tell you it’s nothing and more than manageable. And what would a person living in a hut in Africa with six months left to live think about the fact that you feel like life isn’t worth living, just because you owe people money?

Imagine you were talking to your 5 year-old self. Would they care if you were in debt, or ask you to play? Or what would Richard Branson say? He would probably tell you it’s nothing and more than manageable. And what would a person living in a hut in Africa with six months left to live think about the fact that you feel like life isn’t worth living, just because you owe people money?

4. Expand your idea of wealth.

The biggest mistake many of us make is thinking that the only abundance available to us is money. Often we are very rich in other ways, but not letting ourselves see this stops us from breaking through depression.

Make it a habit to take time every morning (as you brush your teeth works) to notice five ways you are successful and blessed. What are your inner resources? Do you have good friends? A healthy body? Do you live in a nice city?

5. Recognise what you CAN change.

Debt can have you so mono-focussed on your inability to make the money you need, you don’t see all the things you CAN take care of that can make you feel better faster.

For example, could you start taking better care of yourself with exercise so that you sleep better? Could you maybe stop dating that person who isn’t very nice to you?

The more you building a solid foundation of emotional wellbeing, the more you will have the clarity and strength to deal with your debt.

6. Make a plan. On paper.

Depression affects our motivation. The more we are depressed about debt and want to fix it, the less energy we unfortunately feel to actually do so. It becomes easier to just let things slide. And put your head in the sand. This is where a plan can really help.

If you have ‘head in the sand’ syndrome, know debt has never to this day been known to clear up or go away by ignoring it. Making a game plan to deal with your debt can cause anxiety, yes. But it’s better to go through that anxiety then deal with the years of prolonged anxiety not making a practical plan will create.

And write down the plan of what you owe and what things could help, from contacting a debt counsellor to asking for a promotion at work. A psychology professor at Dominican University found that people were 42% more likely to achieve a goal they committed to paper than one they didn’t.

7. Stop blaming yourself.

Nobody chooses to have money troubles. And there are usually good reasons we end up in debt. Often, it’s just lack of knowledge, and we didn’t grow up with parents who educated us about money. Or perhaps you grew up in an environment where you were never allowed nice things and wanted your life to be different, or to spoil your children so they never felt the lack you did.

Recognise that if you had of known how money and debt works, you probably would have done it better. Think of it this way. If your best friend turned around and told you she was in terrible debt, would you tell her she was a failure? Then why are you treating yourself like one?

Have your debt problems left you drowning in depression? Read our article on free to low cost therapy, or check out our sister booking site that includes therapists working at very affordable rates.

Andrea M. Darcy is a mental health and wellbeing expert and personal development teacher with training in person-centred counselling and coaching, as well as a popular psychology writer. Follow her on Instagram for helpful life tips @am_darcy

Andrea M. Darcy is a mental health and wellbeing expert and personal development teacher with training in person-centred counselling and coaching, as well as a popular psychology writer. Follow her on Instagram for helpful life tips @am_darcy

Good advice. But it doesn’t contemplate the circumstances of people who have been made redundant after the recession, after long careers and loyal services. Or people in their mid fifties who have had their salaries cut to almost 50% and are in charge of teenagers who want to go to University and continue to depend on their parents. So debt its not only the result of bad management of your own finances, it can be like a knife in the middle of your life that comes like the worst nightmare and keeps growing because of a system that makes poor people poorer through financial traps. Financial products sold by people who are getting richer and richer thanks to your agony. And the horror of leaving behind the debt for your children to pay.

It sounds like you are really struggling and angry. If your debt has left you feeling completely overwhelmed (our piece on debt and depression might be helpful https://www.harleytherapy.co.uk/counselling/lwren-scott-debt-depression.htm) then do try to find support. There are hotlines like the Samaritans, might be a free support group in your area (check with your local council or your local branch of Mind UK) or see our guide to free or low cost counselling (https://www.harleytherapy.co.uk/counselling/low-cost-therapy-free-counselling-services.htm).

Hello.. chris..

Am glad I came across this. Someone I got relieved after going through the steps. I think I will start applying them.

Thank u.

Glad to be of help! Debt can feel so disheartening and overwhelming, but you are not your debt. If you feel overwhelmed, don’t be too embarrassed to reach out for help, there are even many charities here in the UK that offer free debt counselling. Best, HT.